No annual fees for the first year

Credit limit up to SAR 100,000

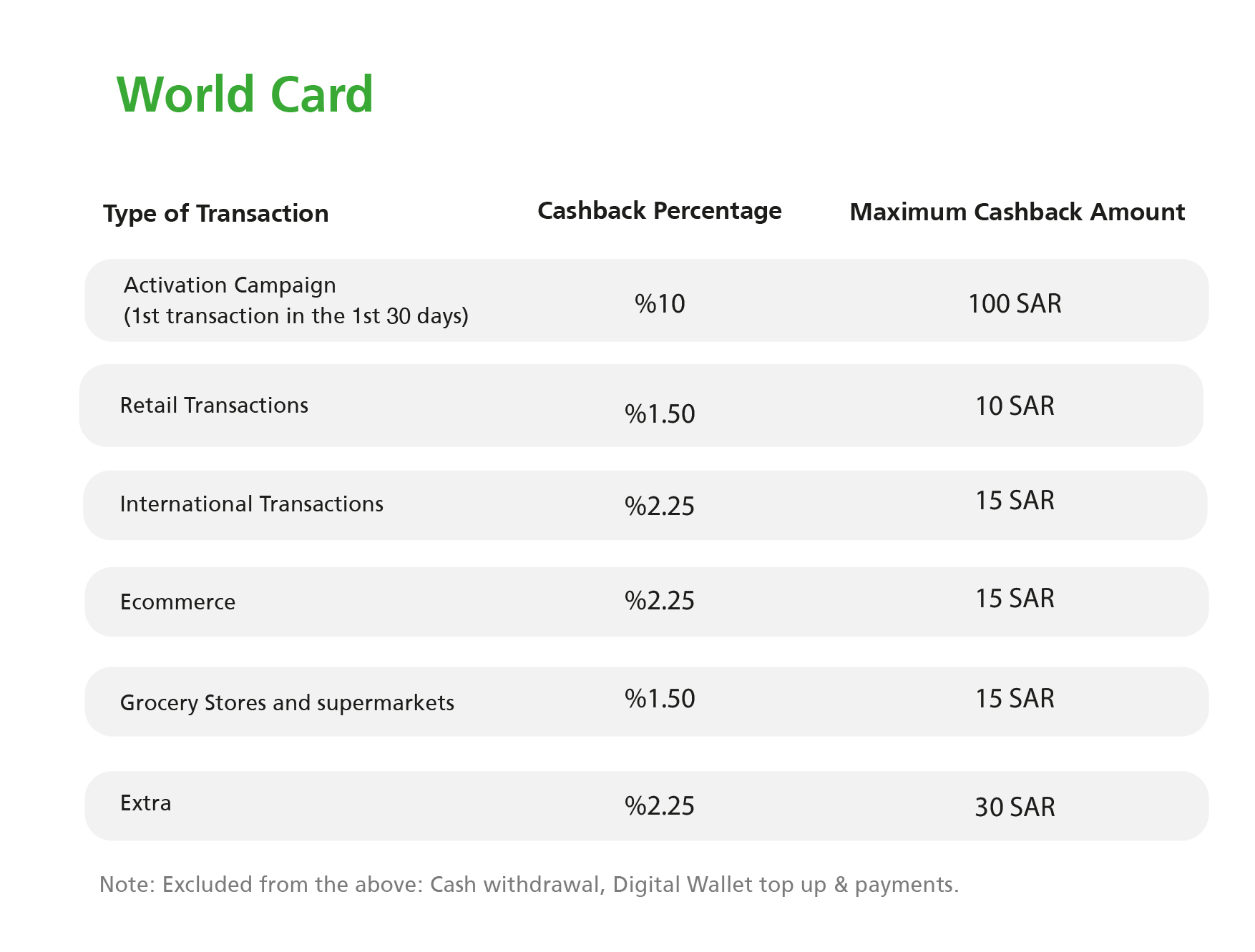

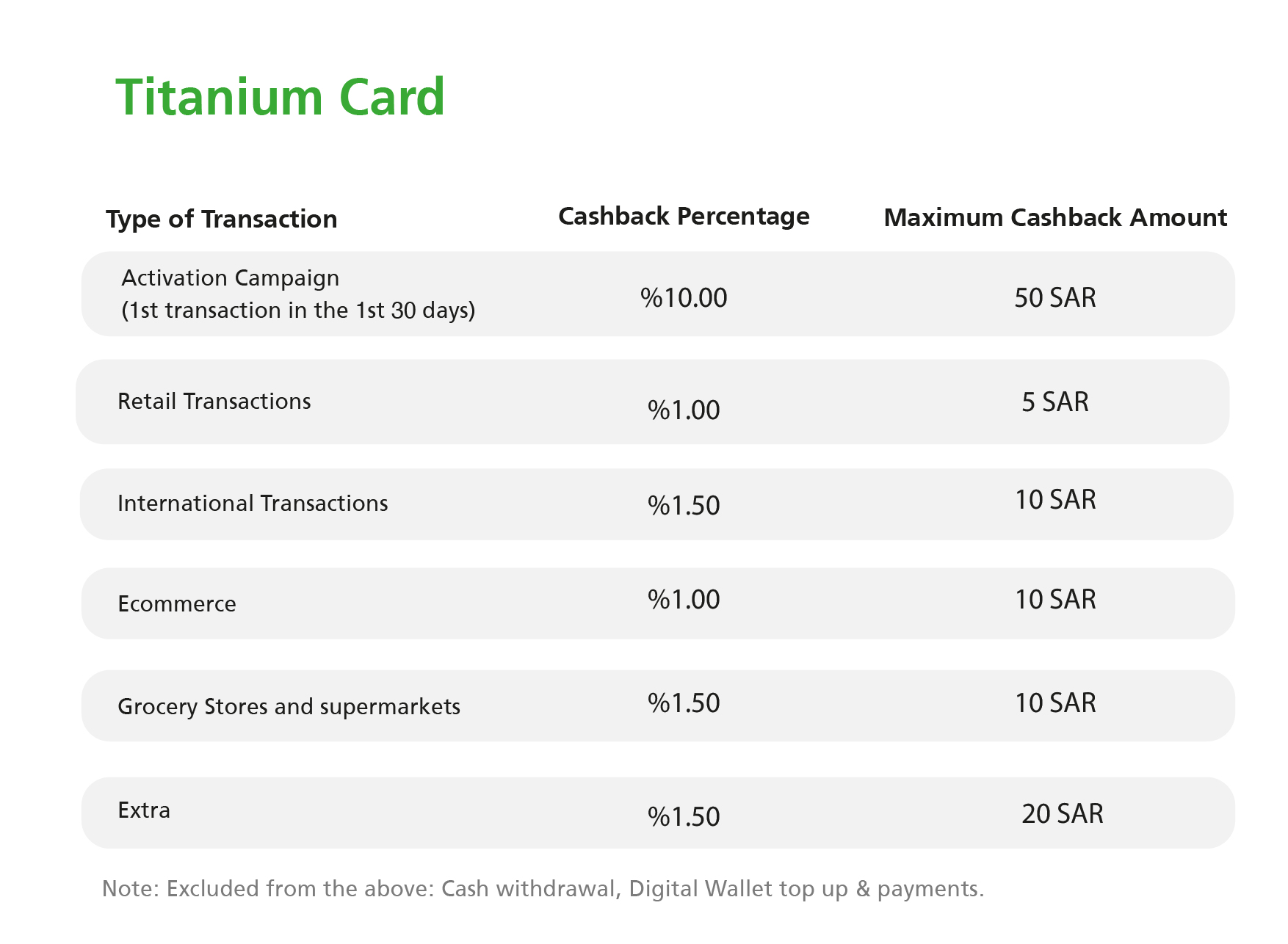

Cashback up to 2.25%

Shariah Compliant

Tap & Pay with Apple Pay

Flexibility in repayments (pay only min 5% monthly)

Two card, unlimited benefits

Spend More, Get More. Calculate your cashback now!

Apply in 4 easy steps

Sign in

Apply for finance and choose Credit Card

Fill in your application and click on apply

Sign the contract and the card is on its way to you

-

1

Sign in

-

2

Apply for finance and choose Credit Card

-

3

Fill in your application and click on apply

-

4

Sign the contract and the card is on its way to you

Apply now

Offers

All OffersLet us answer your questions

you can apply easily for any of our credit cards online via our website or mobile app or by visiting our offices inside eXtra stores across the kingdom, or by calling us at 8003044434

No, the credit cards from Tasheel does not require a guarantor or a sponsor.

No, the credit cards from Tasheel does not require a salary transfer

The minimum limit is SAR 2,500 while the maximum limit is SAR 100,000

Yes, Tasheel credit cards are shariah complaint, and all its processes are approved by the Shariah board

We are here to help

Couldn't find what you were looking for?

Why wait?

Apply in few steps through our mobile application

Download the app now